Improving Literacy on the Benefits and Risks of Borrowing, OJK Holds Seminar at FEB UNUD

In order to increase literacy on the benefits and risks of fintech peer-to-peer lending (P2P lending) or often known as online loans (pinjol) in Indonesia, the Financial Services Authority (OJK) together with the Faculty of Economics and Business, University of Udayana (FEB Unud) held a The seminar entitled OJK Goes to Bali 2022 on Thursday (30/06).Services Authority (OJK) together with the Faculty of Economics and Business, University of Udayana (FEB Unud) held a The seminar entitled OJK Goes to Bali 2022 on Thursday (30/06).

This activity aims to introduce the role and benefits of using credit card to the public (especially students and UMKM), introduce the dangers of illegal lending, explain the role of OJK in regulating and supervising the loan lending industry, and encourage increased financial inclusion in Indonesia.

The seminar was officially opened by the Director of Supervision of the OJK Regional 8 Bali-Nusra Financial Services Institution, Ananda R. Mooy. stated that the development of the times and increasingly technology still makes financial institutions compete to innovate in their financial products. One of the financial service innovation products offered is loan services. He continued, the need for financial services for the community is divided into two categories, namely productive and consumptive. Financial services for the productive sector are financial services intended for business development activities, generally businesses in the UMKM scale. Meanwhile, financial services for the consumptive sector are financial services aimed at daily financial needs, such as the need to buy consumer goods.

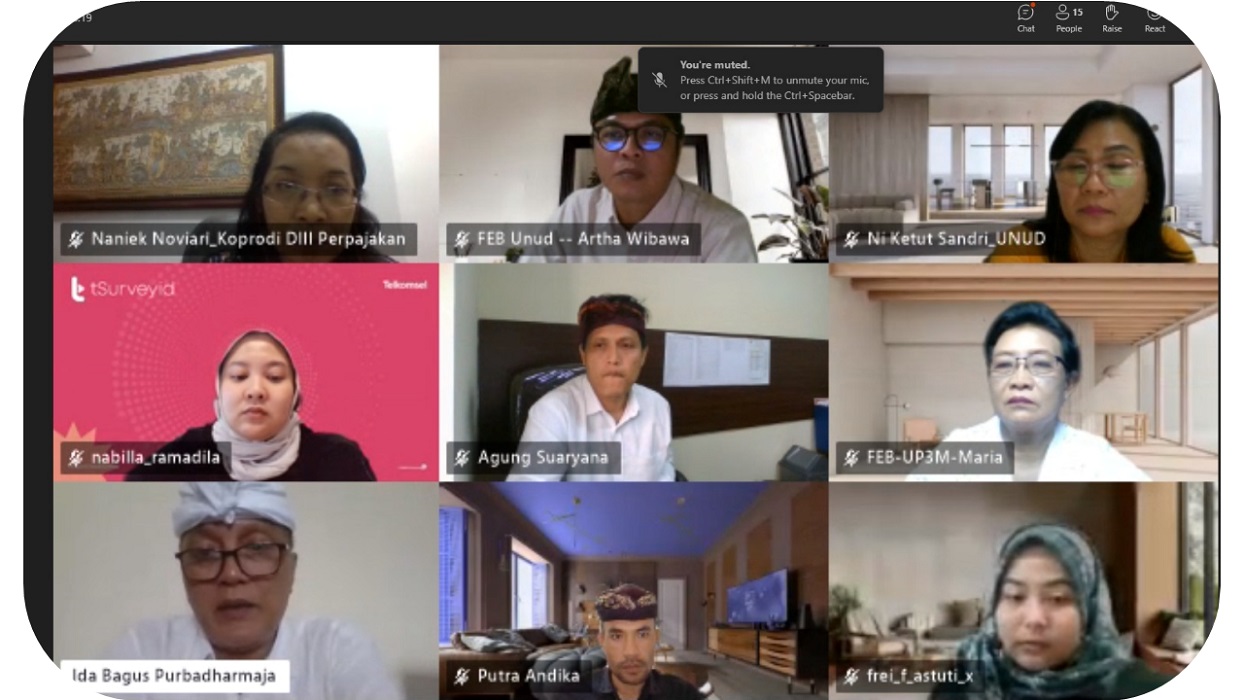

Deputy Dean for Academic Affairs and Planning (Vice Dean I) FEB Unud, Dr. Ida Bagus Putu Purbadharmaja, S.E., M.E., who had the opportunity to give a speech, stated that this seminar was a form of implementation of cooperation between OJK and FEB Unud. The Deputy Dean I of FEB Unud also expressed his gratitude because OJK made a real contribution in the form of seminars which were very important for the general public, especially students and MSME players.

The seminar which was held in the BH Building Hall, Unud Sudirman Denpasar Campus, was filled by Tris Yulianta (Director of Regulation, Licensing and Supervision of OJK Fintech); Tongam L. Tobing (Head of Task Force 18 Investment Alert); Kuseryansyah (Executive Director of the Indonesian Joint Funding Fintech Association?AFPI); Putu Agus Ardiana (Lecturer of FEB Unud) and Moderator Ni Putu Ayu Darmayanti, SE. MM.